mortgage rates ny trend

Rates were well above 4 as recently as 2018 and 2019. Although they were a little higher to end the year rates in 2016 averaged 365.

|

| Current Mortgage Interest Rates December 2021 |

When there are fewer buyers available the yields on mortgage bonds have to go up to attract purchasers.

. Current mortgage interest rates are still very good from a long-term view even if theyre breaking through the psychological barrier of 4. With higher rates come fewer offers. In 2015 mortgage rates fell back to 385 as the market calmed down. Mortgage costs have jumped as the Federal Reserve has raised rates.

Todays mortgage rates in New York are 4904 for a 30-year fixed 4071 for a 15-year fixed and 3632 for a 5-year adjustable-rate mortgage ARM. New York conforming loans PROGRAM RATE 1W CHANGE APR 1W CHANGE. The table below is updated daily with New York mortgage rates for the most common types of home loans. That turned out to be wrong.

Mortgage rates are based on certain indexes. Mortgage Rate Trend. April 14 2022 209 pm. The average rate for a 15-year fixed mortgage is 243 which is an increase of 6 basis points from the same time last week.

This growth will be seen in the mid-to higher-end price tier not the entry-level priced homes making it. Mortgage rates rose to 5 percent for the first time in over a decade raising the pressure on the housing market and adding another burden to home buyers who were already struggling with. The inventory forecast for 2019 is moderate coming in between a 6-7 percent increase. Mortgage rates rose to 5 percent for the first time in over a decade raising the pressure on the housing market and.

Lawren Yun chief economist at the National Association of Realtors. In fact rates dropped in 2019. Written by Zach Wichter As of Monday April 11 2022 current rates in New York are 498 for a 30-year fixed 409 for a 15-year fixed and 269 for a 51 adjustable-rate mortgage ARM. Is 2019 a good year to buy a home.

Apply online and contact up to four lenders about your new mortgage. The average mortgage rate went from 454 in 2018 to 394. The index is expressed as an average. As such the best use of any timely accurate rate index is to observe the day-to-day change.

Mortgage Rate Trends View Refinance Rate Trends As of Apr. In response to Bankrates weekly poll 73 percent said rates are headed higher. Show Recessions Download Historical Data Export Image. 10 2022 Loan Types Select up to three 3 Region Show national average Timespan 471 30 Yr Fixed 397 15 Yr Fixed 325 51 ARM Mar 13.

Current mortgage rates in Long Island NY are for a 30 year fixed rate loan for a 15 year fixed loan and for a 51 adjustable rate mortgage ARM Mortgage Program Todays Long Island NY Rates National Average Comparison 30 Year Fixed Rate 3850 15 Year Fixed Rate 3090 51 Adjustable Rate Mortgage 2970. Mortgage experts mostly think rates will rise in the coming week March 10-16. Meanwhile 18 percent said they would. Check out our other mortgage and refinance.

What are todays mortgage rates. This may be the best time to obtain a new loan. By looking at the average mortgage rates in New York since 2010 you can see trends for 30-year fixed mortgages 15-year fixed mortgages and 71 adjustable mortgages. For today April 10th 2022 the current average mortgage rate on the 30-year fixed-rate mortgage is 5089 the average rate for the 15-year fixed-rate mortgage is.

Send any friend a story As a. The mortgage rates trend continued to decline until rates dropped to 331 in November 2012 the lowest level in the history of mortgage rates. The APR includes both the interest rate and lender fees for a more realistic value comparison. Compared to a 30-year fixed mortgage a 15-year fixed mortgage with the.

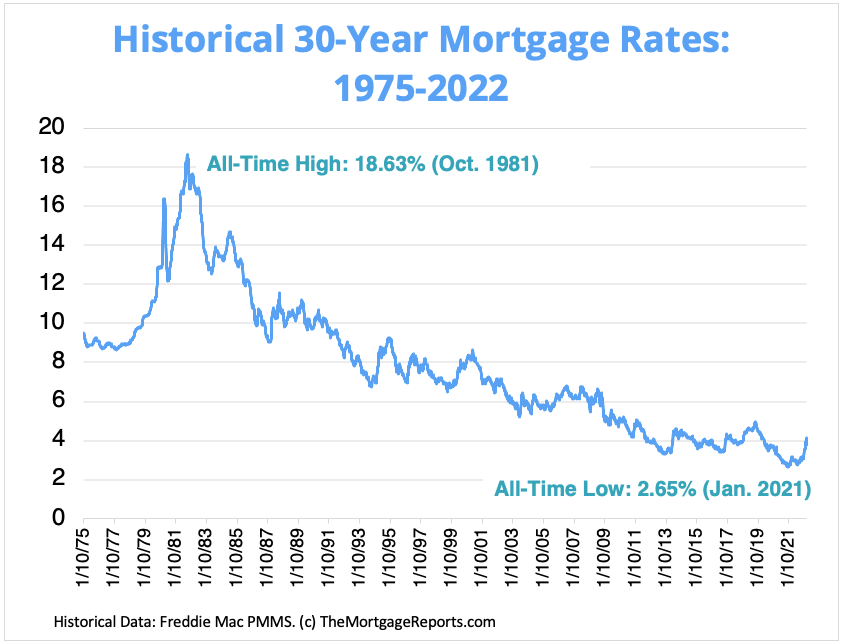

30-Year Fixed Rate Conforming Mortgage Index. That means the monthly cost of buying a typical home has surged by more than a third over the past year. To put it into perspective the monthly payment for a 100000 loan at the historical peak rate of 1863 in 1981 was 155858 compared to 43851 at the historical low rate of 331 in 2012. Home mortgage rates just hit 5 for the first time in more than a decade.

30 Year Fixed Mortgage Rate - Historical Chart Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971. Actual rates tend to be offered in 0125 increments. This also causes mortgage rates to rise. Percent Daily Not Seasonally Adjusted 2017-01-03 to 2022-03-18 12 hours ago Origination Fees and Discount Points for 51-Year Adjustable Rate Mortgage in.

The mortgage rates trend continued to decline until rates dropped to 331 in November 2012 the lowest level in the history of mortgage rates. Michael Fratantoni chief economist for the Mortgage Bankers Association MBA says rates could reach 4 by the end of 2022. In 2018 many economists predicted that 2019 mortgage rates would top 55. Compare week-over-week changes to mortgage rates and APRs in New York.

Mortgage rates are low and many predict that rates will be rising soon. Rates went up to 417 in 2014. The current 30 year mortgage fixed rate as of March 2022 is 467. If you qualify for a fixed rate loan you probably will only be interested in the current state of such indexes since your.

Loan-to-Value Less Than or Equal to 80 FICO Score Between 700 and 719.

|

| Agbo5fvxuoyi1m |

|

| 47 Of House Hunters Would Feel More Urgency If Mortgage Rates Hit 3 5 Survey |

|

| Mortgage Rates Approach 4 Much Faster Than Expected |

|

| Mortgage Rate Charts Historical And Current 1975 2022 |

|

| Mortgage Rates Forecast Will Rates Go Down In April |

Post a Comment for "mortgage rates ny trend"